Financial Services

Member Accounts

Whether it’s a lifelong dream or a weekend getaway, Amherst Federal Credit Union offers a variety of great savings options to help you get there. Our deposit accounts let you earn competitive interest rates while keeping your money totally liquid so you can get to it when you need it. The National Credit Union Administration (NCUA) federally insures our credit union and each member’s deposits are backed by the full faith and credit of the United States Government to $250,000.

Share (Savings) Accounts

Every member is an owner of the Credit Union. A deposit of one share – $5.00 – is required for membership. Shares held in a savings account are the primary benefit of that ownership.

Dividends are declared and paid quarterly by the Board of Directors. Statements are sent to members quarterly along with a copy of our newsletter.

When a member’s Share Account is inactive for twenty-four months or more, an account fee of $15.00 is charged each quarter. An account is considered “inactive” when there is no deposit or withdrawal by the member. Payment of dividends is not classified as account activity. After five years of inactivity, the account is declared abandoned under New York State Law and turned over to the Office of the State Controller.

Share Draft (Checking) Accounts

Our checking account service is available to every qualified member. Your first 30 checks are free and you may apply for a ATM or Visa Debit Card. With our free online Home Banking you can access your account balances, make transfers, nickname accounts, view statements and much more! Easy-to-read and easy-to-use monthly statements are also provided. Save your checks and manage your bills online with free bill pay. No monthly service or minimum balance fees apply. We recommend payroll deduction or direct deposit as a convenient way to make deposits.

Fresh Start Share Draft (Checking) Accounts

As a community credit union, Amherst FCU strives to offer products and services to helps members obtain low cost, reliable service with personalized attention to the financial needs of every member. We realize that some members may not be eligible for a regular share draft (checking) account due to past account use or unforeseen circumstances. The Fresh Start Checking account offers a second chance to bank responsibly, ideally leading up to full share draft account access. Now you may have the same type of access to your money as anyone with a regular checking account, but for much less than dealing with check cashers. Restrictions and monthly fees apply. Each application is subject to management approval based on the applicant’s ChexSystems report. Not all members will qualify. Call the credit union for more information.

ATM Cards

ATM service is available for withdrawals from Shares (Savings) Accounts and Share Draft (Checking) Accounts. Enjoy fee-less withdrawals from our ATM network including M&T and Allpoint ATMs.

Visa® Debit (Check) Cards

Visa® debit cards work just like a credit card only the funds are taken directly from your checking account. Use your debit card for purchases or cash withdrawals from an ATM. The Visa® debit card may be used in conjunction with Overdraft Protection so you never have to worry about the cost and inconvenience of bouncing a check. Since the card carries the Visa® logo, it is accepted worldwide.

ATM Service

Use your Check Card or ATM card for withdrawals from your savings or checking account with the credit union. Your first 6 transactions a month are surcharge free at any Allpoint or M&T Bank ATM. Please keep in mind that there may be transaction fees and/or surcharge fees that apply. Check out Allpoint’s online ATM locator or download the free smart phone application to find ATMs on the go!

Club Accounts

Enroll for payroll deduction or Direct Deposit to be sure to have enough money set aside for holiday expenses. Make automatic deposits every payday. Club money is automatically transferred into your share (savings) account around the 1st of November.

Overdraft Protection

Avoid bounced checks and payments with multiple layers of overdraft protection. By default, your draft (checking) account is linked to your share (savings) account for automatic overdraft protection with a small fee of $5.00 per automatic overdraft transfer. Amherst FCU will also manually transfer funds from attached and joint accounts when applicable as overdraft protection for a small fee of $8.00 per manual overdraft transfer. You may sign a request to opt-out of automatic and manual overdraft protection, though this may result in checks or payments bouncing and larger non-sufficient funds fees being assessed in lieu of the overdraft protection fees. Members may also apply for an overdraft line of credit.

Term Share Certificates & IRA Accounts

Term share certificates are similar to certificates of deposit offered by other financial institutions. The interest rate is guaranteed for the term of the deposit. We offer one year terms at very competitive rates. Our minimum term share certificate deposit is $1,000.00. When it’s time to open a new certificate or roll over an old one, be sure to compare our rates to other area institutions. Like all Credit Union deposits, our Certificates are insured by NCUA through the NCUSIF, an agency of the federal government.

Use our Term Share Certificates for regular, Roth and Education IRA accounts. Ask about contributory IRA accounts to build your balance each payday until it’s large enough for a Term Share Certificate.

Student Accounts

Share (Savings) Accounts

Every member is an owner of the Credit Union. A deposit of one share – $5.00 – is required for membership. Shares held in a savings account are the primary benefit of that ownership. Dividends are declared and paid quarterly by the Board of Directors. Statements are sent to members quarterly along with a copy of our newsletter.

When a member’s Share Account is inactive for two or more years and the balance is less than $100, an account fee of $6.00 is charged each quarter. An account is considered “inactive” when there is no deposit or withdrawal by the member. Payment of dividends is not classified as account activity. After five years of inactivity, the account is declared abandoned under New York State Law and turned over to the Office of the State Controller.

Ages 16+

Share Draft (Checking) Accounts

With a parent or guardian’s signed authorization, our checking account service is available to every qualified member. Your first 30 checks are free, and no monthly service or minimum balance fees apply. Account statements are issued monthly or may be viewed online.

Direct Deposit/Payroll Deduction

Starting your first job or trying to save money? Amherst FCU accepts both Direct Deposit (entire paycheck) and Payroll Deduction (as little as $5.00/pay) from most employers. Setting up a Direct Deposit or Payroll Deduction is a great way to save and allow quick and easy access to your funds or to build your savings. This service may be changed at any time upon your request.

ATM Cards

Use your ATM card for withdrawals from your savings or checking account with the credit union. You may use your card at any Allpoint or M&T Bank ATM machine, where your first 6 transactions a month are surcharge free.

Visa® Debit (Check) Cards

Visa® debit cards work just like a credit card only the funds are taken directly from your checking account. Use your debit card for purchases or cash withdrawals from an ATM. Since the card carries the Visa® logo, it is accepted worldwide.

ATM Service

Use your Check Card or ATM card for withdrawals from your savings or checking account with the credit union. Your first 6 transactions a month are surcharge free at any Allpoint or M&T Bank ATM. Please keep in mind that there may be transaction fees and/or surcharge fees that apply. Check out Allpoint’s ATM locator on our website or download the free smart phone application to find ATMs on the go!

High School Seniors

College Scholarships

- Hughes - Demmin Scholarship: due by April 1, 2025

- Amherst Academies Scholarship: due by April 1, 2025

Click here for Scholarship Application

Ages 18+

Wherever you are in your higher education, get the money you need for school. Student loans from Amherst Federal Credit Union in partnership with Sallie Mae® could help!

Sallie Mae® student loans are designed for the needs of all types of students.

- Competitive interest rates

- Multiple repayment options

- No origination fees; no prepayment penalty1

Smart Option Student Loan® for undergraduate and career training students.

Plus, the graduate loan suite is designed to meet the needs of students in specific fields of study.

Borrow responsibly

We encourage students and families to start with savings, grants, scholarships, and federal student loans to pay for college. Students and families should evaluate all anticipated monthly loan payments, and how much the student expects to earn in the future, before considering a private student loan.

These loans are made by Sallie Mae Bank. Amherst Federal Credit Union is not the creditor for these loans and is compensated by Sallie Mae for the referral of loan customers.

Applications are subject to a requested minimum loan amount of $1,000. Current credit and other eligibility criteria apply. Click here for additional eligibility information about each product.

1 Although we do not charge a penalty or fee if you prepay your loan, any prepayment will be applied as outlined in your promissory note—first to Unpaid Fees and costs, then to Unpaid Interest, and then to Current Principal.

SALLIE MAE RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS, SERVICES, AND BENEFITS AT ANY TIME WITHOUT NOTICE.

©2024 Sallie Mae Bank. All rights reserved. Sallie Mae, the Sallie Mae logo, and other Sallie Mae names and logos are service marks or registered service marks of Sallie Mae Bank. All other names and logos used are the trademarks or service marks of their respective owners. SLM Corporation and its subsidiaries, including Sallie Mae Bank, are not sponsored by or agencies of the United States of America.

Student Visa® Credit Card

Begin establishing your good credit rating with the Amherst FCU Student Visa credit card. Available for college students ages 18-25, our Student Visa gives you the same great benefits as our Visa Classic credit card with the added advantages of a low fixed rate that keeps monthly payments easy to manage. View Forms and Applications

Rate: 12.90% Fixed APR*

Term: Open-ended line of credit

Minimum Payment: 3% of balance due

Maximum Credit Line: $1,000, subject to credit approval

Student-Run Credit Union Branch

The Amherst FCU staff and board of director are excited to announce our partnership with the Amherst Academies to launch a student-run credit union branch at Amherst High School!

The Amherst Academies are a comprehensive Career and Technical Education program with the goal of preparing students for lifelong success.

Students applied and interviewed for positions at the school branch and those selected will be thoroughly trained in customer service and cash handling. Their role in running the school branch, under the supervision of an Amherst FCU employee, will to be assist students, faculty and staff with basic transactions and new accounts.

Our goal is to provide students valuable professional experience from the convenience and safety of their school and to encourage positive financial habits.

For the safety and security of Amherst High School, access to the student-run branch is limited to Amherst High School students, faculty, staff and administration only.

The school branch will during lunch hours every Friday in which school is in session.

The Amherst High School Credit Union branch has been made possible, in part, by a grant from the New York Credit Union Foundation.

Business Accounts

Business Share (Savings) Accounts

Business Share Accounts are available for small businesses- DBA’s or Partnerships. In order to establish membership, a share account must be opened. A deposit of one share – $5.00 – is required for membership. Shares held in a savings account are the primary benefit of that ownership.

Dividends are declared and paid quarterly by the Board of Directors. E-Statements are sent to members quarterly along with a copy of our newsletter. ATM service is available for withdrawals from Shares (Savings) Accounts and Share Draft (Checking) Accounts.

All business accounts are subject to the same fee schedule as member accounts.

When a Share Account is inactive for two or more years and the balance is less than $100, an account fee of $6.00 is charged each quarter. An account is considered “inactive” when there is no deposit or withdrawal by the member. Payment of dividends is not classified as account activity. After five years of inactivity, the account is declared abandoned under New York State Law and turned over to the Office of the State Controller.

The following forms are needed in order to open the share account:

- A certified copy of a DBA Certificate or Certificate of Incorporation from NYS

- Federal Tax ID number

- Government issued ID for individuals opening the account

Business Share Draft (Checking) Accounts

Our checking account service is available to every qualified member who has a share account. There are no minimum balance requirements for share draft accounts. Share Draft accounts do not earn a dividend. You may apply for an ATM or Visa® Check cards to be used with this account, and your first 50 checks are free.

ATM Access

ATM at Daemen College

We have installed an ATM in the Athletic Center at Daemen College for members to use without fees. This ATM has been made possible, in part, by a grant from the New York Credit Union Foundation.

Surcharges and Transaction Fees

Surcharges are sent by the owner of the ATM and are normally taken as part of the withdrawal from your account. This fee is waived for the first 6 transactions each month.

Surcharge Free ATM Locations

Use your Check Card or ATM card for withdrawals from your savings or checking account with the credit union. Your first 6 transactions a month are surcharge free at any Allpoint or M&T Bank ATM. Please keep in mind that there may be transaction fees and/or surcharge fees that apply. Check out Allpoint’s online ATM locator to find ATMs on the go!

ATM Cards

Use your ATM card for withdrawals from your savings or checking account with the credit union. You may use your card at any Allpoint or M&T Bank ATM machine, where you first 6 transactions a month are surcharge free.

Visa Debit (Check) Cards

Visa® debit cards work just like a credit card only the funds are taken directly from your checking account. Use your debit card for purchases or cash withdrawals from an ATM. The Visa® debit card may be used in conjunction with Overdraft Protection so you never have to worry about the cost and inconvenience of bouncing a check. Since the card carries the Visa® logo, it is accepted worldwide.

Online Services

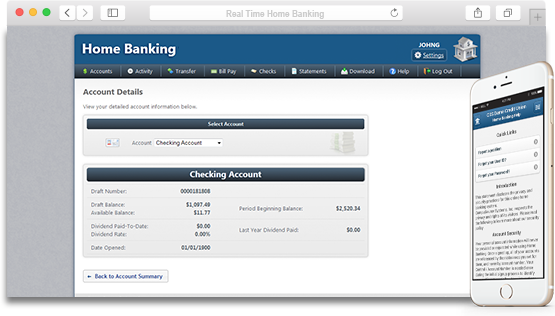

Real Time Home Banking

A Better way to bank.

Online access to your accounts is available to all members at no charge. Transfer funds, check balances, view cleared checks (if available) and verify transactions all from the comfort and convenience of your own home. It’s fast, it’s safe and it’s FREE! Home Banking services are done in real time. Please keep in mind that most transactions will be posted the same business day but others may take longer due to unforeseen circumstances.

Bank on your time, anywhere!

View account balances, transfer funds and more, all from the palm of your hand.

Card Valet

“Amherst FCU is pleased to offer CardValet®, a mobile card management application that helps reduce account fraud by allowing cardholders to monitor accounts with their smartphone and control how, when and where their debit card is used.

Click her for more informationMobile Check Deposit

Deposit checks from your smartphone with our new Mobile Check Deposit feature within our Mobile Banking App for Apple and Android devices!

You are required to read our Mobile Check Deposit Disclosure before proceeding. Your usage of the Mobile Check Deposit application is subject to your cell phone carrier’s regular data fees.

- You may access Mobile Check Deposit by logging into your Mobile/Home Banking account from your smartphone or tablet.

- Select Mobile Deposit from the Home Banking menu in the top left corner or from the Mobile Deposit button in the bottom right corner.

- Fill in each field including the amount of your check, the account you’d like it deposited into, and then follow the prompts to take pictures of the front and back of your check.

- Mobile Deposits will appear in your account by 4:30pm on the same business day if submitted before 1:30pm. Mobile Deposits submitted after 1:30pm will appear in your account on the next business day.

Continued use of our Mobile Check Deposit program is subject to approval based on account usage and member history. For more information, please call the credit union at 634-3881.

Bill Pay

Pay your bills online with a click of the mouse! Once you are enrolled in our free electronic bill payment, you may set up payees, individuals or businesses to which you want to make payments to. You will create payment schedules and either set up a one-time payment or recurring payments. Online Bill Pay is only available in conjunction with a draft (checking) account.

Visa Credit Card Access via eZcardinfo

Review transactions in real time, set alerts, make payments from internal and external accounts, view statements, and access ScoreCard Rewards all from your computer or smartphone. Enroll your AFCU Visa Credit Card with the “Visa login” option on our menu or visit https://ezcardinfo.com.

Consumer Loans

We offer low rates and competitive terms on loans for new and used auto loans, recreational vehicle loans, personal loans and share secured loans. There are no application fees! Please call the credit union at (716) 634-3881 if you have any questions about our loan products.

Click here to view current promotions for exclusive offersNew & Used Auto Loans

Searching for just the right vehicle can be extremely time consuming. Don’t waste additional time searching for a place to finance your loan. Our rates are competitive and we can often match or beat most dealers’ rates. The loan application process is quick and convenient, and the service you’ll receive is friendly and efficient. We finance both new and used vehicles.View Forms and Applications.

Motorcycle Loans

New and used motorcycle loans work just like new and used auto loans, and they come with the same competitive rates and terms.

Lease Buyouts and Refinancing Auto Loans

Transfer your vehicle loan from any other lender to take advantage of our low rates. This is especially attractive during our Auto Loan Sales, typically offered multiple times a year, featuring rate discounts and special bonuses on top of our already competitive loan terms.

Recreational Vehicle Loans

The credit union also offers financing for boats, RVs, travel trailers, jet skis, and snowmobiles at competitive rates. Let us help you finance your dream vehicle!

Personal Loans

Personal Loans are available to qualified members for any worthwhile purpose in any amount from $500 to $12,000. Use this kind of loan for a wide variety of expenses such as home improvement, medical or legal expenses, education expenses, debt consolidation or taxes. View Forms and Applications.

Debt Consolidation Loans

Debt Consolidation Loans are available as either a Visa credit card balance transfer, a signature loan, or a home equity fixed-rate loan. Make an appointment with one of our staff members for assistance with the management of your current debts.

Share Secured Loans

Use this low-rate loan to obtain a loan while still keeping your savings account intact. Use your shares or term share certificate to secure your loan.

Other Secured Loans

Loans may be secured by offering other insured, independently appraised, personal property or investments such as stocks, bonds or certified shares in a mutual fund. Call our office to ask for details.

Thank a Vet Discount Program

AFCU participates in the Thank a Vet discount program through the Erie County Clerk’s Office. AFCU offers ½% discount off of the applicant’s qualifying rate for any personal loan or new/used auto loan held elsewhere. The program-issued photo I.D. card must be presented. For more information please visit the Thank a Vet program website. All applications subject to approval.

Real Estate Loans

Buying and owning a home is certainly a worthwhile financial goal, but some aspects of the process can be complex, expensive, and downright exasperating. We’re here to make this experience enjoyable – and to keep your stress level and payments low!

Click here to view current promotions for exclusive offersMini Home Equity Line of Credit

A “Mini” Home Equity Loan is a convenient, affordable way to turn equity in your home into a ready source of cash for almost anything you need.

- Finance amounts from $1,000.00 to $30,000.00

- A fixed rate with terms from 36 months to 60 months

- One time advance of funds

- Up to 90% financing of funds

- Use your home as security

- No closing costs when open for a 1 year minimum

- Loan interest may be tax deductible

Do you need extra money quickly without extra paperwork or hassles? Do you own your own home? Inquire about a “Mini” Home Equity, it may be the perfect answer. Call our loan department for more information at (716) 634-3881 or click here for a printable application. Certain terms and conditions apply.

Home Equity Line of Credit

This service is an open end Line of Credit designed for members interested in a Home Equity Loan with the convenience of a line of credit. Members are able to take advances as needed, rather than a lump sum. A line of credit is easy, convenient and the interest is tax deductible! Contact our loan department for more details or click here for a printable application.

- Finance amounts from $10,000-$200,000

- Terms up to 15 years

- Choose between a variable rate and a fixed rate. The variable rate is tied to prime rate and may change only two times per year.

- Up to 85% financing of funds

- No closing costs when open for 3 year minimum

- Loan interest may be tax deductible

- Disability and credit life insurance available on any loan for eligible applicants

Notice to Borrowers

The SAFE Act requires financial institutions that originate mortgage loans (Home Equity Loans, Home Equity Lines of Credit, Mini Equity Loans and First Mortgages) to register with the Nationwide Mortgage Licensing System & Registry (NMLS). Loan Officers at financial institutions that are involved with mortgage loans in any aspect are considered Mortgage Loan Originators (MLO) and must also be individually registered with the NMLS. Each financial institution and MLO are assigned unique ID numbers. It is the consumers’ right to verify that the financial institution and/or Loan Officer are registered with the NMLS. The NMLS Consumer Access website is: www.nmlsconsumeraccess.org.

The following employees of Amherst Federal Credit Union (463322) are registered MLO’s with the NMLS:

Cindy Tichenor MLO#1432430

Jolene Bosworth MLO#1476119

Keri Walczyk MLO #583635

Stacey Koczaja MLO#1432021

Visa Credit Cards

A Credit Union Visa® Credit Card gives you a convenient way to make purchases at more than five million places and get emergency cash from thousands of locations worldwide. Record keeping is easy with a monthly Visa® account statement.

Click here to view current promotions for exclusive offersVisa® Platinum Credit Cards

The Visa Platinum Card offers a low fixed rate with no annual fee. Use this card for purchases and cash advances world-wide. Arrange for automatic monthly payment from your Credit Union account with Direct Deposit or payroll deduction. Click here for online or printable applications.

Rate: 8.95% Fixed APR*

Term: Open-ended line of credit

Minimum Payment: 3% of balance due

Minimum Credit Line: $5,000.00 (not all members will qualify)

Maximum Credit Line: Variable, subject to credit approval

Visa® Classic Credit Card

For members who prefer a smaller credit line, our Visa Classic Credit Card also offers a fixed rate with no annual fee. Use this card for purchases and cash advances world-wide. Arrange for automatic monthly payment from your Credit Union account with Direct Deposit or payroll deduction. Click here for online or printable applications.

Rate: 12.90% Fixed APR*

Term: Open-ended line of credit

Minimum Payment: 3% of balance due

Maximum Credit Line: Variable, subject to credit approval

Introducing Our Student Visa® Credit Card

Begin establishing your good credit rating with the Amherst FCU Student Visa credit card. Available for college student ages 18-25, our Student Visa gives you the same great benefits as our Visa Classic credit card with the added advantages of a low fixed rate that keeps monthly payments easy to manage. Click here for online or printable applications.

Rate: 12.90% Fixed APR*

Term: Open-ended line of credit

Minimum Payment: 3% of balance due

Maximum Credit Line: $1,000, subject to credit approval

Scorecard Rewards Program

Every card holder is automatically enrolled in the Scorecard Program where you can earn valuable rewards. Receive one point for every dollar spent. Redeem your points to earn all kinds of wonderful gifts including your choice of merchandise or travel rewards.

Please note that Scorecard Bonus points are not earned for balance transfers.

Balance Transfers

Once approved for one of our Visa® Credit Card products, you are able to transfer balances held at other financial institutions or stores at no charge. This is especially attractive during our Visa Platinum Balance Transfer promotions, during which you may transfer balances held elsewhere onto your new AFCU Visa® at a lower interest rate until the balance is paid off in full.

Verified by Visa®

We are proud to participate in the Verified by Visa Program – a free service that gives you password protection when you shop online.

Manage Your Visa Debit Card Online via eZcardinfo

Review transactions in real time, set alerts, make payments from internal and external accounts, view statements, and access ScoreCard Rewards all from your computer or smartphone. Enroll your AFCU Visa Credit Card with the “Visa login” option on our menu or visit https://ezcardinfo.com.

*APR represents Annual Percentage Rate. All loans subject to approval, rates may vary from those listed based on term and credit qualifications. Other rates and terms available. Special promotional rates may apply. Please call the Loan Department for details.

For your convenience, we are providing online loan calculators to assist you in your financial planning. Please note, however, that these calculators are made available to you only as self-help tools for your independent use and are not intended to provide any investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances.

All examples are hypothetical and are for illustrative purposes only. We encourage you to seek personalized advice from qualified professionals in regards to all of your personal finance issues.

Loan Caluclator

Savings Calculator

Other Products and Services

Amherst Federal Credit Union offers you a number of other free or discounted services.

| Extras | |

|---|---|

| Notary Service | Free for members |

| Regal Cinema Gift Cards | $10.00 & $25.00 |

| Visa Gift Cards | $4.00 activation per card |

| Visa Travel Cards | $5.00 activation per card |